ARTICLE

Insight

Four years after the “Cosmetics Industry Vision,” the future of J-Beauty hinges on “public-private cooperation.

The “Cosmetics Industry Vision,” formulated in April 2021 by the Ministry of Economy, Trade and Industry (METI) and the Japan Cosmetic Industry Association (now the Japan Cosmetic Industry Association), is the first vision for the future of the cosmetics industry to be developed by industry, academia, and government. The current status of the industry and future challenges were discussed in a dialogue between Mr. Masatoshi Kobayashi of METI, Mr. Takashi Hasegawa, editor of Monthly International Commerce, and Mr. Kensaku Hamada of i-Style.

※This article is an edited version of the conversation that took place in “ampule magazine vol.13” with additions to the parts that could not be published in the magazine.

What’s?Cosmetics Industry Vision

The Cosmetics Industry Vision was formulated in April 2021 by the Ministry of Economy, Trade and Industry (METI) and the Japan Cosmetic Industry Association (now the Japan Cosmetic Industry Association) as the secretariat, and is the first vision for the future of the cosmetics industry developed by industry, academia, and government. The Japan Cosmetic Industry Association (JCIA) and domestic cosmetics makers are members of the study group, which aims to strengthen competitiveness in the global market by promoting the development of high value-added products, the creation of new customer experiences through the use of digital technology, and the development of diverse human resources.

I thought you saw the increase in sales due to inbound as domestic demand?

――What is the background behind the development of the “Cosmetics Industry Vision” for 2021.

Kobayashi Discussions on the formulation of the vision began in 2020 with the Corona Disaster. This was a time when environmental regulations in Europe were becoming stricter and consumers were becoming more aware of the SDGs. At the same time, South Korea and China were experiencing phenomenal growth, so I heard that everyone in industry, academia, and government was working in the same direction to find ways for Japan to adapt to the coming changes in the environment.

I have only been involved in the cosmetics industry for less than a year, but it seems to me that the movement after formulation is slow. I believe that people in the cosmetics industry are very quick to follow immediate trends and have a good sense of how to respond to them, but it is difficult to see any movement in terms of how they should view things from a medium- to long-term perspective and how they should deal with the environment in their field itself. I have a feeling that there is a major issue in this area.

Hasegawa I participated as an observer. I believe that the current situation and problem of the cosmetics industry is that after discussing the general issues, the movement is slow when advancing each issue. This is partly due to the influence of Corona, but also because the cosmetics industry has long been nurtured by domestic demand and has been able to do so independently to begin with. We were not accustomed to responding to changes, and if we did, it was only domestically. In the midst of all this, Korea began to dominate the market and took more and more areas overseas. Japan did not take advantage of the inbound market until 2019 while taking the global market at the same time. It is not a small circumstance that the Corona disaster worsened their own performance and forced them to prioritize the reform of their domestic business.

――ISTYLE also operates stores overseas. How do you analyze the changing position of Japanese brands overseas.

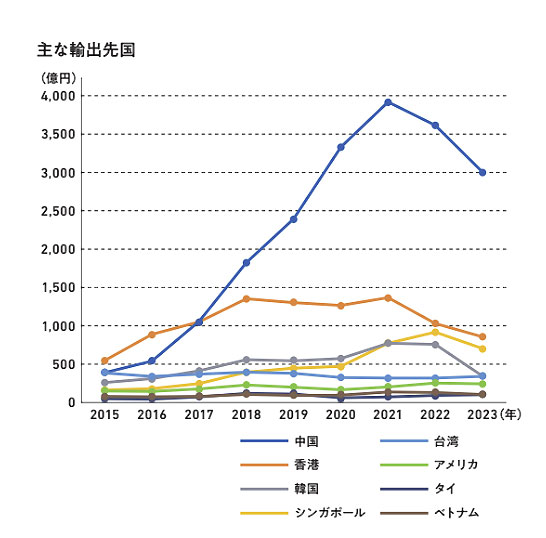

Hamada I think Japan was treating the boost triggered by inbound sales until 2019 as if it were domestic demand. At that time, a virtuous cycle was taking place and sales in China were also selling in the Japanese way without any marketing. Then suddenly the numbers in China started to drop steadily and we started doing marketing, but we had to catch up on a lot of things like social networking and e-commerce. I feel that the timing of realizing the turning point in our overseas response was delayed, partly because it coincided with Corona.

Also, trade hurdles vary from country to country, but exports to China are very strict and Hong Kong is very loose. In other words, the tougher China gets, the more goods turn to Hong Kong. Where do they then turn from Hong Kong to mainland China? Even if they do not sell, only inventory goes into mainland China from various sources. This leads to more products and lower prices. Since the manufacturer has no control over the price, this leads to brand damage, and everything becomes a negative cycle.

Digitalization, the Pharmaceutical Affairs Law and the Act against Unjustifiable Premiums and Misleading Representations, and many other issues to be addressed in the future.

――What is the status of overseas expansion of Korean cosmetic brands.

Hamada Since Korea is a smaller country than Japan, it was not originally possible to do business only domestically, so we have been looking overseas from the time of product creation. They consider packaging and catch copy with a global audience in mind, and they also use world-class talent. I feel that this big difference is becoming more and more visible here. However, there is no need to give up on Japan either. You can check the list of products purchased by foreigners at actual at-cosmetics stores. When you look at where they are buying cosmetics from, you will see that Japanese brands are by no means unpopular. If we can devise a way to sell Japanese products, it would be a step in the right direction.

Hasegawa I agree with that. The fact that foreigners are buying Japanese products in droves proves the power of the Japanese brand.

They do not buy cosmetics at every store, but rather at stores that have an interesting presentation and a value-added experience. We should learn from the fact that cosmetics are sold in places where value is created beyond the product itself.

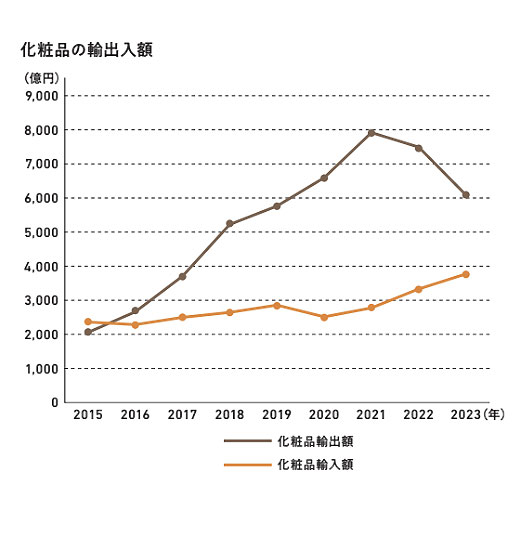

Kobayashi The value of each country’s cosmetics exports is growing in Europe, the U.S., China, and South Korea, but the opposite is true for Japan. The value of Japan’s cosmetics exports has dropped by about 200 billion yen from 2021 to 2023. Of that amount, China will account for about 100 billion yen. It is not that the Chinese market has made it impossible to export, but that exports to other countries have fallen overall. I am still wondering if there is a reason for this. One concern I have is the concept of J-Beauty, which is mentioned in the Cosmetics Industry Vision. K-Beauty may not have a clear definition, but when consumers hear the term “K-Beauty,” they think of a specific image, such as K-Pop or an actor.

I was originally involved in agricultural affairs and environmental policy for a long time. For several years, the Japanese government has been aiming for sales of 5 trillion yen by exporting Japanese agricultural products overseas, but here, too, we faced the same challenge as in the case of cosmetics. Although the Japanese government has been aiming for sales of 5 trillion yen by exporting Japanese agricultural products overseas for several years, it has faced the same problem as in the case of cosmetics. Under such circumstances, effective PR cannot be done forever, and Japan-brand shelves cannot be built overseas. Having witnessed this series of events, I feel that it is difficult to simply launch the name J-Beauty.

※As for exporting countries from Japan according to the Ministry of Finance Trade Statistics, exports to Hong Kong and China have been rising since 2015, and 50% of total cosmetics exports are to China from 2020 onward. (See graph on the left.).

※According to Ministry of Finance Trade Statistics, the value of exports of cosmetics from Japan has been higher than that of imports from Japan since 2016. (See graph on the right).

Hasegawa For example, if positive images such as “Japanese women are cool” spread throughout the world, fashion and food would sell, and hair salons might be able to open. How can cosmetics be built on top of the cultural infrastructure that has been created? The importance of working with Cool Japan to promote this was discussed at the Cosmetics Industry Vision meeting.

Kobayashi Digitization is also important. Overseas, QR codes are printed on packages, but now, due to regulatory restrictions, Japanese packages are written in fine text in tight spaces. We would like to introduce electronic tags specifically for cosmetics and take other measures to prevent counterfeit products. I also feel the need to bring the Pharmaceutical Affairs Law and the Act Against Unjustifiable Premiums and Misleading Representations in Advertising, etc. into line with global trends. We must nurture the industry while rotating both the promotion of exports and the optimization of regulations.

Hamada I have some personal thoughts on regulation. In the past, the protection system in an open world maintained fairness. But now, with the digital evolution, it has become possible to create a closed environment within social networking sites. I believe that we should assume that the standards of the Act against Unjustifiable Premiums and Misleading Representations and Misleading Representations and the Pharmaceutical Affairs Law will not only become looser but may also cease to function in the future.

It is important for manufacturers to make proposals to METI and work together with them.

――What should each company do to bring innovation to the cosmetics industry in Japan?

Hasegawa As Japan’s cosmetics industry goes global, we need to work out where to target and where to establish a bridgehead. I also think that we should work together with the government and focus on creating sales floors that take advantage of Japan’s strengths and new contacts with foreign countries. There are some things that are difficult for manufacturers to do alone, so it will be important for the public and private sectors to work together in discussions that transcend corporate boundaries and make proposals to the relevant ministries and agencies.

Kobayashi It is true that there are many things that only the private sector can do, such as how to sell to the market. However, with unprecedented changes in the environment taking place, there must be something that the government can do to step forward even further. To this end, I would like to ask the cosmetics industry to first raise the resolution of the issues on its side before consulting with us. The higher the resolution, the easier it will be for us to extract measures and take concrete action. Since we are unable to devote that much manpower to the cosmetics industry, which accounts for less than 1% of GDP, we hope that the public and private sectors can work together to promote measures.

Hamada I would like the companies to know more about what Mr. Kobayashi mentioned. I would be especially happy if young people would think about inputs that they can propose to METI on a regular basis and take concrete actions. I believe that this will change the relationship between the public and private sectors.

Hasegawa The cosmetics industry needs to show itself that by initiating the creation of a cultural infrastructure, it will have a ripple effect on other industries, including those with higher GDP than cosmetics. In addition, the distribution side is under pressure to achieve Scope 3 (the amount of greenhouse gases emitted in the process from procurement of raw materials to manufacturing, sales, consumption, and disposal of products). This will mean that only environmentally friendly products can be placed on the shelves, and non-compliant products may fall off the shelves. However, investing in environmental responsiveness is difficult, especially with the capital resources of small and medium-sized enterprises. This is where I would like to see the government provide backup.

――Please give us your final message.

Hasegawa The power of the Japanese retail industry to create and maintain the quality of a great sales floor is amazing. The power of Japanese brands is increased when good products and good brands are combined there. For example, when I look at @cosme TOKYO, the flagship store of at-cosme, which offers everything from high-priced to petit-price cosmetics, I feel the value of being able to compete on a global scale. This is the only store of its kind in the world. I hope we can further demonstrate this wonderful innovation overseas.

Hamada There are not many places other than Japan where customers are given lectures by beauty salons on how to use cosmetics. Today, foreigners are enjoying the experience of “choosing cosmetics in the store and asking for advice when they have a problem” as much as Japanese people do, with a smartphone in hand and translations in hand. I think we can provide them with more information on beauty theory and how to use cosmetics, but it is not realistic for us to research each and every company and create content for them. It would be great if we could provide a platform for at-cosmetics by having the manufacturers provide us with information and then editing it to create a section.

Kobayashi Until now, the relationship between government and the cosmetics industry has mainly been to ensure the safety of the public through regulation. However, looking at the trends in the world, historical movements, and changing circumstances, we believe that now is the right time for industrial policy. I would like to work together with everyone in the industry to sweat for the sustainable development of the cosmetics industry.

GUEST PROFILE

Takashi Hasegawa Born in Yokohama, Kanagawa Prefecture in January 1979, Takashi Hasegawa joined Kokusai Shogyo Shuppan in February 2011 and is assigned to the editorial department of Kokusai Shogyo, a magazine specializing in the cosmetics and household products industry. He is an observer of the “Cosmetics Industry Vision” and was involved in the launch of the "Cosme Bank Project. In his private life, he is a father of two children. Masashi Kobayashi Joined the Ministry of Agriculture, Forestry and Fisheries in 1994. He received his M.S. in Environmental Studies from Cornell University and has been in his current position since July 2024. He has been engaged in international negotiations on the safety of genetically modified organisms and the use of digital sequence information, as well as the promotion of the cosmetics industry. Hazama Kensaku Joined Istyle in April 2005 after working for a consulting firm; appointed Executive Officer of Istyle in July 2015 and Senior Vice President in July 2018; responsible for business for cosmetics brands from July 2020. From July 2020, he will assume the position of Segment Manager of the Brand Experience Segment, which oversees business for cosmetics brands.

Photo/Takuhiro Okamoto, Text/ Miki Sekine